What Lendroid offer?

Lendroid is a trustless, open, peer to peer digital asset platform based on the Ethereal blockade.

The Lendroid market allows borrowers to take advantage of fast, cheap digital assets loans and loans to earn interest on the digital assets they lend. In addition, holders of the Lendroid support token act as the guarantor of this loan by locking their LSTs as a secondary guarantee. The Lendroid platform is expanded by design and enables the creation of loan markets on any ERC20 token.

Lendroid tries to overcome the limitations of on-chain latency and improper gas costs by creating a symbiotic off-chain infrastructure supported by incentive participants. Original tokens create network operations, trigger protocol utility layers and offer security to community governance. Ecosystems maintain a decentralized and global decentralized pool of lending.

introduction

Lendroid is a trustless, open, peer to peer digital asset platform based on the Ethereal blockade. The Lendroid market allows borrowers to take advantage of fast, cheap digital assets loans and loans to earn interest on the digital assets they lend. In addition, holders of the Lendroid support token act as the guarantor of this loan by locking their LSTs as a secondary guarantee. The Lendroid platform is expanded by design and enables the creation of loan markets on any ERC20 token.

What is Lendroid?

Lendroid is a protocol without the quotes 0x, non-rent, trust-independent, open protocol that enables decentralized lending, margin trading and short supply on Ethereal blockchain. It aims to address the shortcomings of centralized exchange by creating a joint global pool of loans, and symbiotic off chain infrastructure supported by incentive participants - Relayers and Wranglers. Simply put, the Lender donates their offer to the lending pool via wirer, which then matches the offer with the appropriate merchant. Traders can use the loan funds to restrict trade, generate profits, and repay creditors.

What is Margin Trading?

If a trader wants to monetize his confidence in the price of an increasing / decreasing asset, he will take a position by buying / selling the asset. If he is very confident, he will build a leverage position by borrowing additional funds from the lender to enlarge his profits.

How Lendroid Enable Loans and Margin Trading?

Loans - A borrower pledged a digital asset into an escrow account, with special conditions for the loan set out in the smart contract. If the terms of the lender and the borrower match, the smart contract is executed, lock the collateral and release the funds to the borrower's funds. If the loan obligations are met by the borrower, then the collateral is not automatically locked. If the borrower fails to pay or the collateral falls below the value of the agreed loan, the collateral is liquidated.

Margin trading - Margin trading begins by depositing a collateral. Traders are allowed to borrow up to some extent to the point where margin rates are greater than the initial level (established through community governance). Loan funds come from a pool of joint loans where the creditor may bid. With borrowed funds, the trader interacts with the order book to calibrate the position to reflect expectations of future price movements. As soon as the traders feel it's time to let go of their position, the trader once again interacts with the order book.

If a trader makes a profit, he can pay off the creditor and withdraw his profits along with his collateral.

In the event of a loss, the trader is expected to deposit the difference to compensate losses, repay the loan in full and only then withdraw the collateral.

If the account reaches the level of liquidation, the multiplier enters and takes over the account / position

How does Lendroid work?

A loan contract itself is quite straight forward. But then, who corrected the terms of the loan? How do borrowers find and persuade lenders? How do we ensure borrowers have an incentive to pay back? What happens if the borrower fails to pay for it? etc

Lendroid market allows the creation of several loan markets.

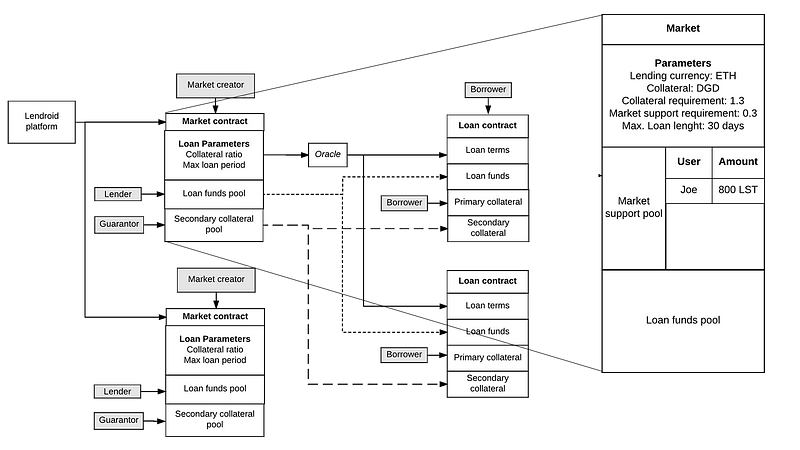

Lendroid platform architecture

Lendroid support token (LST) is the original token of the Lendroid protocol. Market creators (holders of Lendroid support tokens) propose new markets using a unique set of loan terms (combinations of types and collateral ratios).

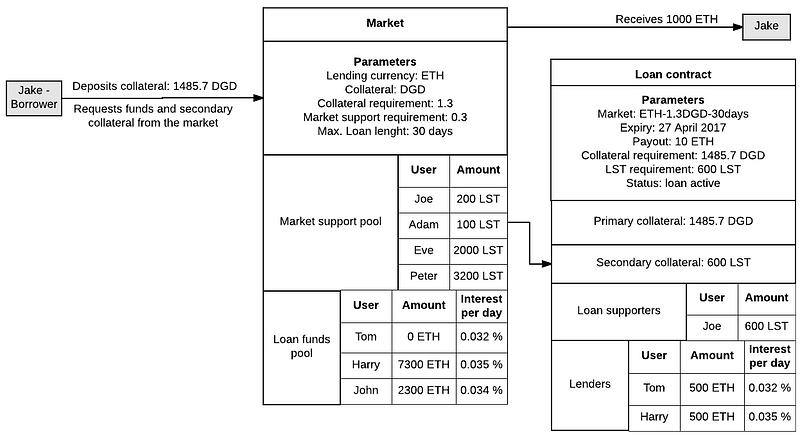

Lenders and guarantors find, collect and fund markets that offer the terms of the loans they want (terms that they believe will keep the loan solvent, protect their investments and enable them to make money). Guarantor is an LST holder who chooses to provide support to the market issuing loans that they think will remain solvent and payment properly, in which case they receive a portion of the interest. If the loans become bankrupt, they will lose their deposit. It is a requirement of each loan to hold LST at least 20% of the value of the loan. LST deposits act as a secondary guarantee for the loan.

Loan payment process

At the end of the loan term, the borrower has the option to extend the loan by adjusting the locked securities or paying off the loan with accrued interest, or the right to lose their collateral.

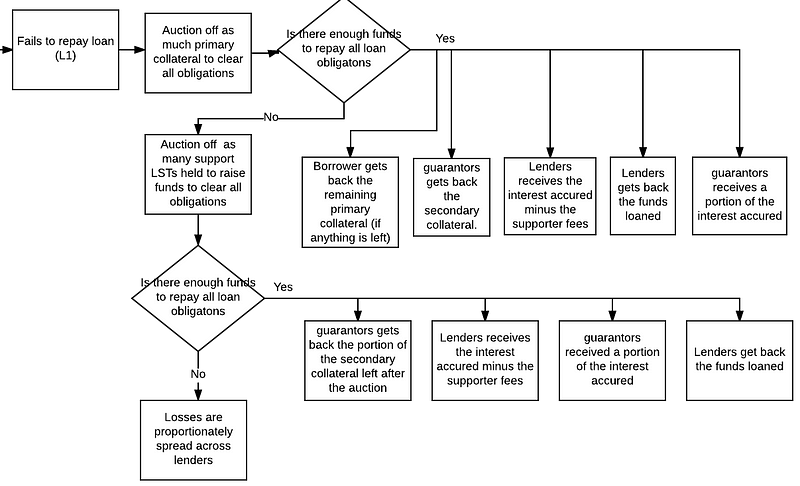

The process of liquidating loans

If the borrower fails to repay the loan, the main loan lent is auctioned. If funds collected at the auction are insufficient to remove all liabilities because secondary securities (funding support tokens) are auctioned off to raise additional funds. If even after auctioning off all the secondary securities locked in the loan, there is not enough funds to pay all creditors, the loss can be spread proportionally to all creditors, and the lender is paid.

The lender receives two layers of protection for the funds they lend. One of the primary collateral value and another from the secondary collateral value. This process increases the creditor's confidence and reduces the burden of the lender's market discovery.

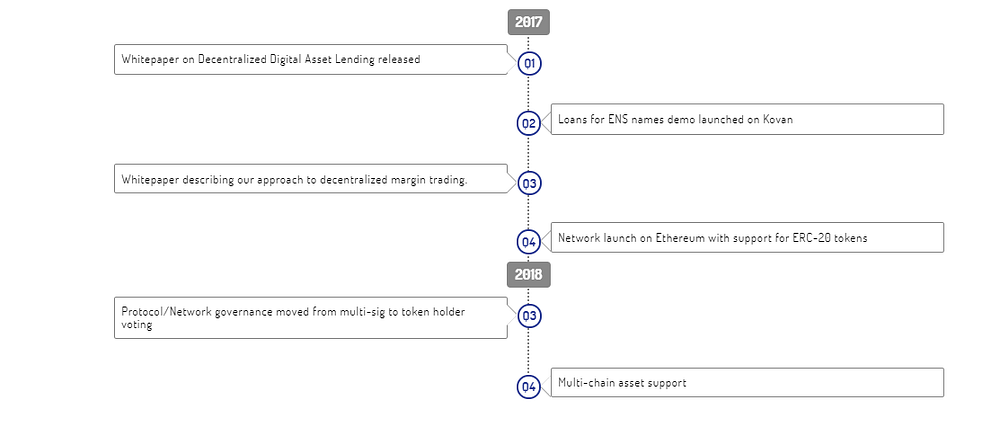

Roadmap

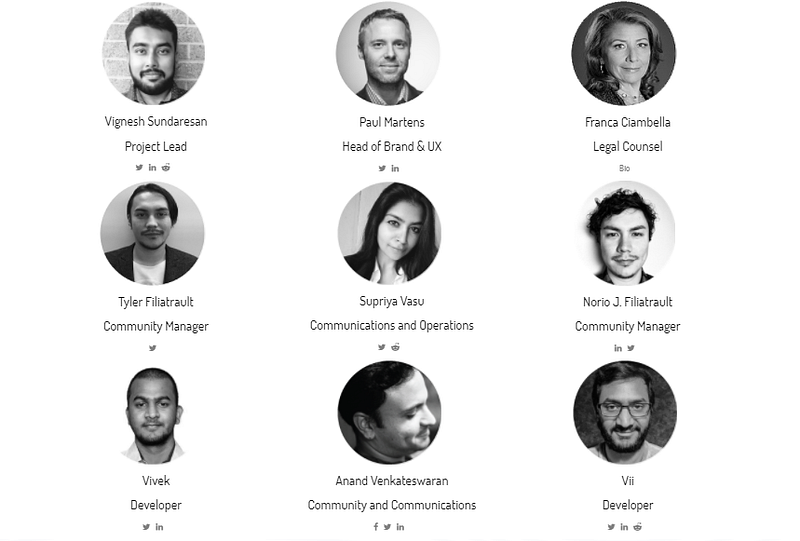

Tim

Detail Information

Website: https://lendroid.com/

Whitepaper: https://lendroid.com/assets/whitepaper.pdf

Twitter: https://twitter.com/lendroidproject

Telegram: https://t.me/lendroidproject

Tidak ada komentar:

Posting Komentar