Hello everyone, how are you? If you are interested in joining the project, it is advisable to read reviews that will help you get information that can help you in seeing your vision and mission:

Last week, we began to consider the Cotrader project . Let me remind you that this is a platform for investing in crypto-currency projects, which helps to earn even a beginner in this market. The essence of the platform is that an investor can entrust his money to an experienced manager and make a profit without wasting time on market research. More details about the project you can from my first review .

In the current review, we will get acquainted with the team, compare with competitors, determine the prospects for capitalization growth.

Leadership and project team

What is the experience of the CEO? Is there any experience in this sector of business? How complete is the team?

Head of

Harry Bernstein (Gary Bernstein) - head of the company. Is a fairly well-known expert in the field of the blockbuster. Works with crypto currency for more than 3 years. He worked as a founder and strategic partner in such projects as Senno , Bitcoin OTC Trading. Prior to that, more than 10 years he worked in various start-ups in managerial positions. He graduated from the University of California. Among the confirmed skills is just the same blockage, the promotion of start-ups, crypto-currencies. I am well acquainted with various trading systems, programming languages.

Command

Eliezer Steinbock (Eliezer Steinbock) - I'm very familiar with programming languages like C ++, Python, Solidity, Javascript. An interesting fact is that he worked for 2 years in the armed forces of Israel, as a software developer for military vehicles.

I worked for a long time in Internet start-ups with different orientations. At the moment is concentrated in the development of the field of blockade.

Pasha Kaza (Pasha Kaza) - Operations Director. He spent a significant part of his career in this position, he also has serious skills in sales, marketing, strategic planning, and development of young companies.

In general, I can note a fairly large team, a large number of regional community managers.

Size of the market and business model

What is the market volume in monetary terms? What are the prospects for market growth?

Volume of the market

Cotrader will operate in several related markets, the main one of which is the crypto-asset management market. This is one of the fastest growing segments of the economy, which, according to some forecasts, by 2025 will be about 335 billion dollars a year. The big plus is the fact that at the moment this segment is in the rudimentary stage of its existence, so Cotrader can become one of its founders and take a large share of the market.

Business model

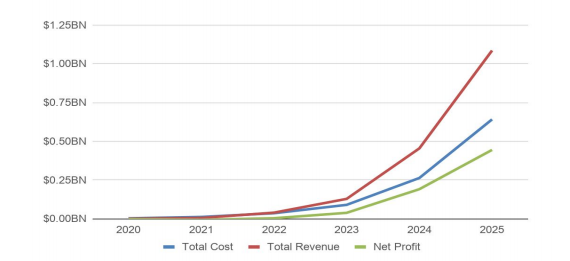

The company's income will consist of commission fees: 4% for the fund management service, and 0.1% commission for transactions on its own decentralized exchange.

According to the calculations of the company, by 2025 the net profit will be about 0.5 billion dollars a year.

Product

At what stage is the product? Do they need customers? Is it difficult to copy it, is there a patent protection?

Product development stage

At the moment, the platform is in the testing stage of its prototype, it is planned to fully launch the functionality until the end of 2018.

Product appeal for customers

The constantly growing demand for trust management in the field of crypto assets once again underscores the relevance of the Cotrader platform. This is not surprising: the history of trust management has been around for almost a hundred years, so it is logical that this form of investment will be relevant in the block-sector.

Competitive environment

What is the structure of the environment? Quality of products from competitors?

Competitors

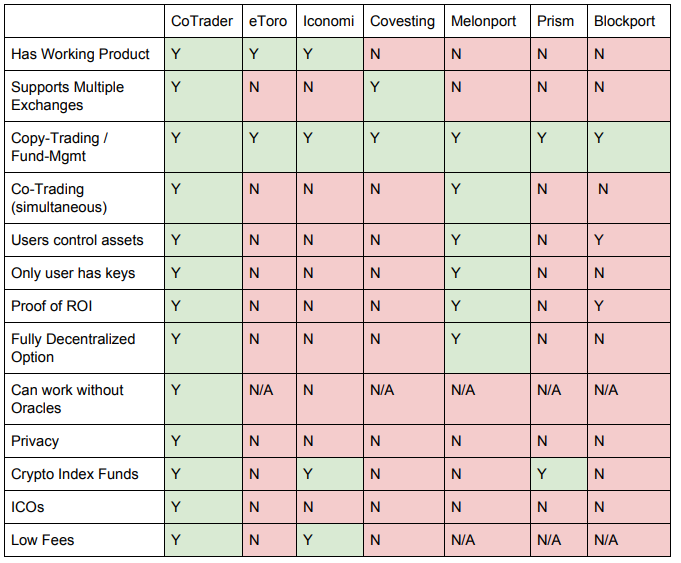

The growing market attracts many start-up companies, among which you can note: eToro, Covesting, MelonPort, Iconomi, Coinbase, Cindx and others. Each of these projects has a number of problems and disadvantages in comparison with Cotrader, the main of which are excessive centralization, early stage of project development or meager functionality.

Comparison with competitors

Other factors

What is the tokenomics of the project? How long is the road map?

Tokenomika

Hard-cap project will be $ 10.0 million, For 1 ETH you can buy 500,000 COT tokens.

To assess the prospects for future growth in the project's capitalization, it will be logical to compare it with its competitors, namely, with their capitalization, maximum and current:

Iconomi : current capitalization: $ 45.67 million, maximum - $ 524.23 million;

Covesting : current capitalization: 13, 46 million, maximum - 49.54 million;

Blockport : current capitalization: $ 4.36 million, maximum - $ 42.03 million;

Prospects for the growth of the project's capitalization are obvious: if even now, during a highly descending market, the capitalization of the main competitors is much larger than $ 10 million.

Road map

The result

Cotrader has every chance of becoming a leading player in the asset management market in the near future.

The strengths of the project are the team, as well as a powerful technological component. A big plus is also a significant fragmentation of the competitive environment, in which there is currently no clear leader, competitors, for the most part, are in the early stages of developing their product.

More info:

Website: https://cotrader.com/

Whitepaper: https://cotrader.com/cotrader-whitepaper-en.pdf

Facebook: https://www.facebook.com/cotrader

Telegram: https://t.me/ cotrader

Twitter: https://twitter.com/cotrader_com

Author : essella

Tidak ada komentar:

Posting Komentar